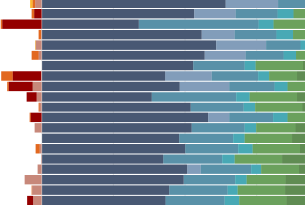

The Policy Impact Calculator dynamically illustrates the relationship among state and federal policies, as well as those policies’ effects on the resources available to a family of three. This recently updated tool demonstrates that state and federal choices about minimum wage, child care subsidies, tax credits, and other benefits result in striking variation.

In the simulation, a full-time working mother with an infant and toddler in the District of Columbia has at least $46,950 to provide for her family, whereas that same mother in Georgia has only $20,560—less than half as much. The dramatic difference demonstrates the consequences of policy decisions for household resources. The Calculator includes all 50 states and the District of Columbia, offering a comprehensive overview of how policies impact the daily life of families.

Find more details on the impact of policy choices on family resources across states.

You can also explore the Policy Impact Calculator directly. Hover over the bar charts to see details on your state’s data.