- Home

- /

- Research Topics

- /

- Economic Supports

Economic Supports

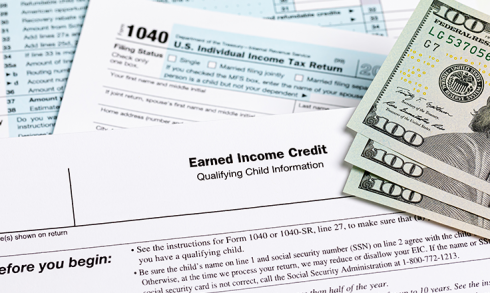

Economic support programs provide relief to those struggling with economic adversity, such as that caused by joblessness, low income, or disability. These programs can help families with children access resources critical to optimal child development. Economic supports can take the form of cash transfer programs, tax credits, or home visiting programs that offer basic needs support.

Featured Resources

A minimum wage establishes a floor for workers’ hourly wages to prevent exploitation by employers and ensure a minimum level of compensation.

What level of resources does a single parent with an infant and a toddler have to provide for their children in your state?

Our analysis demonstrates that the annual public benefits of the elective refundable state EITC program would outweigh its costs.