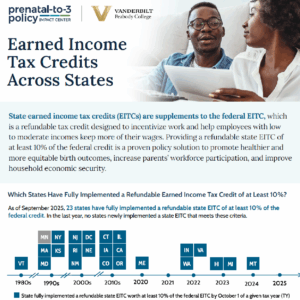

State earned income tax credits (EITCs) provide financial support to low and moderate-income families, offering relief that can reduce poverty and improve economic stability.

Research shows that access to supports such as EITCs can lead to healthier birth outcomes and enhance household wellbeing. Additionally, these credits have proven to incentivize parents’ workforce participation, fostering more prosperous communities.

This brief summarizes key insights from the 2025 State Policy Roadmap’s analysis of states’ progress toward adopting and implementing EITCs.

Learn more about how earned income tax credits vary across states.

The recently updated Prenatal-to-3 State Policy Roadmap provides insight into the core policy levers and further illustrates their interplay through vivid graphics, showcasing the variation in paid family and medical leave policies across states.