Today is Tax Day, and you may anticipate a refund. Maybe you overpaid throughout the year. Or maybe, as a parent, you benefit from the child tax credit. But did you know you may also qualify for a refundable earned income tax credit (EITC), which could bring you an even larger refund? The EITC offers low-to-middle-income individuals or families tax breaks simply by working.

But this credit’s link to a job is just one of the reasons we describe EITCs as “pro-work.” In addition, research shows that EITCs significantly increase mothers’ employment. In this post, we break down this complicated (but beneficial) tax policy.

What is the federal EITC?

The EITC is an example of a “tax credit,” or a government benefit that reduces, dollar-for-dollar, the taxes that taxpayers owe throughout the year. One of the most successful anti-poverty programs in the US, the EITC has been shown to lift 6 million people (including 3 million children) out of poverty annually. For many others, the EITC reduces the depth of poverty. And for near-poor households who struggle to make ends meet, this program offers a much-needed resource boost.

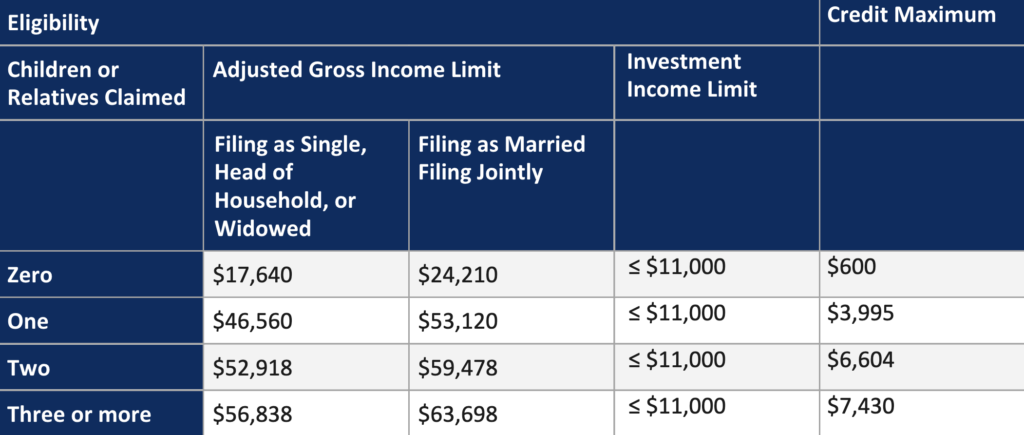

For some anti-poverty programs, such as Temporary Assistance for Needy Families and the Supplemental Nutrition Assistance Program, only those families with the lowest incomes qualify. But families with both low and moderate incomes can benefit from the EITC. In fact, you don’t even need a child to qualify (although households with children benefit far more).

Why is EITC refundability important?

Part of the EITC’s success comes from the credit’s refundability. When credits are refundable, families get the difference between the value of their tax credit and total annual taxes owed to the IRS (i.e., “tax liability”) back in their pockets. In other words, refundable credits reduce the value of a taxpayer’s tax liability, and if the liability is reduced below zero, the taxpayer receives the difference as a refund. For example:

- If John Smith and his family owe or paid $2,400 in federal taxes this year (i.e., have a federal tax liability of $2,400) and qualify for a refundable EITC credit of $3,400, the difference of $1,000 would be credited to them as a refund. If the credit were nonrefundable, however, the remaining $1,000 would not be credited back to them. Rather, the excess $1,000 would be forfeited.

From this example, you can see how refundable credits are particularly valuable to families with low incomes (and little state tax liability). Families with extremely low incomes benefit more, simply because their cost burden relative to their income is much greater. A refundable EITC may also be particularly valuable for families disproportionately impacted by high tax burdens and by high cost of living relative to household resources.

How do state EITCS differ throughout the country?

Eligible households can always take advantage of the federal EITC, but some states offer EITCs as well. As of tax year 2023, 32 states (including the District of Columbia) have an EITC. In those cases, eligible households benefit from both the federal and state credit, maximizing the total value of the credits.

States that offer EITCs make their own determinations regarding credit eligibility, credit value, and refundability. However, states often model their credits after the federal credit, particularly with respect to their eligibility and credit value.

States can (and do) choose to expand eligibility to a greater number of low-income families. Twelve states include specific populations that may greatly benefit from the credit. These populations include:

- Individuals with an Individual Taxpayer Identification Number

- Younger adults without dependents

- Survivors of domestic violence

- Noncustodial parents

States typically set their credits as a percentage of the federal credit. For example, the Massachusetts EITC is set to 30% of the federal credit. In that state, a single mother who has two children and earns the minimum wage will receive a state EITC credit worth 30% of the federal EITC credit value. Because she qualifies for $4,169 in federal credit, she also qualifies for $1,251 in state credit. How this mother receives those credits, however, is determined by the credit refundability.

States typically offer either nonrefundable or refundable credits, but sometimes offer both—allowing families to choose the credit that provides the greatest benefit. Fortunately for the single mother in Massachusetts, both her federal and state credits are refundable. She receives the full value of both credits combined ($5,420).

Clearly, states face a long list of considerations to maximize the effectiveness of a state EITC. Fortunately, our State Policy Lever Checklist can guide state policymakers through the process of crafting legislation.

What should states do?

States should consider adopting a refundable state EITC of at least 10% of the federal credit. There are a few major benefits:

- EITCs, in general, are pro-work. To qualify for both the federal and state credits, you must earn money from a job. Unemployed people are not eligible.

- A refundable state EITC of at least 10% of the federal credit promotes healthier and more equitable birth outcomes, increases parents’ workforce participation, and improves household economic security, with the greatest effects for single mothers and their children.

- EITCs boost state budgets, too. A refundable state EITC of at least 10% of the federal credit offers a large return on investment—at least 7 to 1, according to our analyses on Pennsylvania and South Carolina.

Want to learn more about EITCs and other tax credits?

Research shows that EITCs, child tax credits, and other credits can help ensure all children thrive from the start. For a deeper dive into this topic, register for our webinar on May 24, 1-2:30 pm CT. State Tax Credits: How States Can Leverage Tax Policy to Alleviate Childhood Poverty will cover policies state legislatures can consider to improve economic conditions for families with young children. Click here for all the details. See you there!