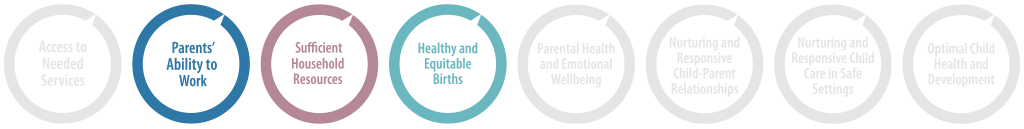

State Earned Income Tax Credit positively impacts these policy goals:

SUMMARY

A refundable state EITC of at least 10% of the federal EITC is an effective state policy to impact:

A refundable state earned income tax credit (EITC) of at least 10 percent of the federal credit promotes healthier and more equitable birth outcomes, increases parents’ workforce participation, and improves household economic security, with the greatest effects for single mothers and their children. The benefits of the federal EITC are more well established in the research than the impacts of state credits, but evidence shows that state EITCs also have significant, positive effects on prenatal-to-3 outcomes.

State earned income tax credits (EITCs) are tax credits for low-income workers and their families that build on the federal EITC. The credits are intended to incentivize labor force participation by increasing the financial returns to work and providing an annual lump-sum income benefit, which may reduce poverty among families with low incomes. States determine whether to offer an EITC in addition to the federal credit, set the generosity of the credit (typically a percentage of the federal credit), determine whether the credit is refundable or only reduces existing tax liability, and decide eligibility within constraints of federal law. Rigorous evidence shows that state EITCs at 10 percent or more of the federal credit increase employment and earnings, improve families’ economic, social, and health outcomes, and reduce disparities in birth outcomes.

Download the Complete Evidence Review

State Earned Income Tax Credit Evidence Review (PDF)

Download the 2-Page Summary

Summary of the Rigorous Research on State Earned Income Tax Credits (PDF)

Recommended Citation:

Prenatal-to-3 Policy Impact Center. (2023). Prenatal-to-3 policy clearinghouse evidence review: State earned income tax credit (ER 05D.0923). Peabody College of Education and Human Development, Vanderbilt University. https://pn3policy.org/policy-clearinghouse/state-earned-income-tax-credit

Updated October 2023