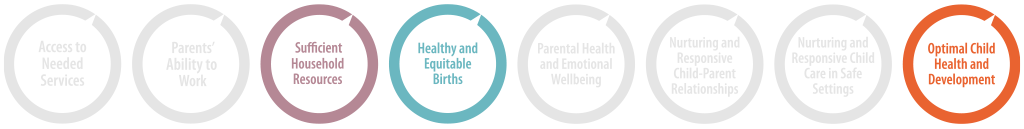

State minimum wage positively impacts these policy goals:

SUMMARY

A state minimum wage of $10.00 or greater is an effective state policy to impact:

A state minimum wage of at least $10.00 per hour increases parents’ earnings and family incomes with minimal or no adverse effects on employment. Higher state and local minimum wages promote greater economic security for families with young children, contribute to healthier birth outcomes, and can reduce racial disparities in poverty. Most of the rigorous research examines the impacts of incremental increases in the wage floor, such as a $1.00 or 10 percent increase, rather than the effects of a specific level (e.g., $10.00, $12.00, or $15.00), but evidence to date suggests that increases to at least $10.00 per hour have positive impacts on infants, toddlers, and their parents. Future research may reveal similar or greater benefits for higher minimum wage levels.

State minimum wage policies establish a floor for workers’ hourly wages. Although the federal minimum wage requires that most hourly workers be paid at least $7.25, states can individually establish higher minimum wages. As of October 1, 2023, 31 states have set wage floors greater than $7.25, with 28 states currently at $10.00 or higher.

By increasing pay for workers with low wages, a higher minimum wage may increase access to basic resources, help to lift families with low incomes out of poverty, and alleviate parental stress. In turn, reduced stress and greater access to resources may improve outcomes for infants and toddlers by reducing the likelihood of adverse early experiences.

Although some studies show positive impacts of minimum wage increases to as high as $12.00 or $15.00, most causal evidence on statewide minimum wages extends to approximately $10.00. As states continue to set minimum wages in the $12.00 to $15.00 range, the effects of levels above $10.00 on families’ economic and social wellbeing will become clearer.

Download the Complete Evidence Review

State Minimum Wage Evidence Review (PDF)

Download the 2-Page Summary

Summary of the Rigorous Research on State Minimum Wage (PDF)

Recommended Citation:

Prenatal-to-3 Policy Impact Center. (2023). Prenatal-to-3 policy clearinghouse evidence review: State minimum wage (ER 04D.1023). Peabody College of Education and Human Development, Vanderbilt University. https://pn3policy.org/policy-clearinghouse/state-minimum-wage

Updated October 2023